What is it good for? Nothing!

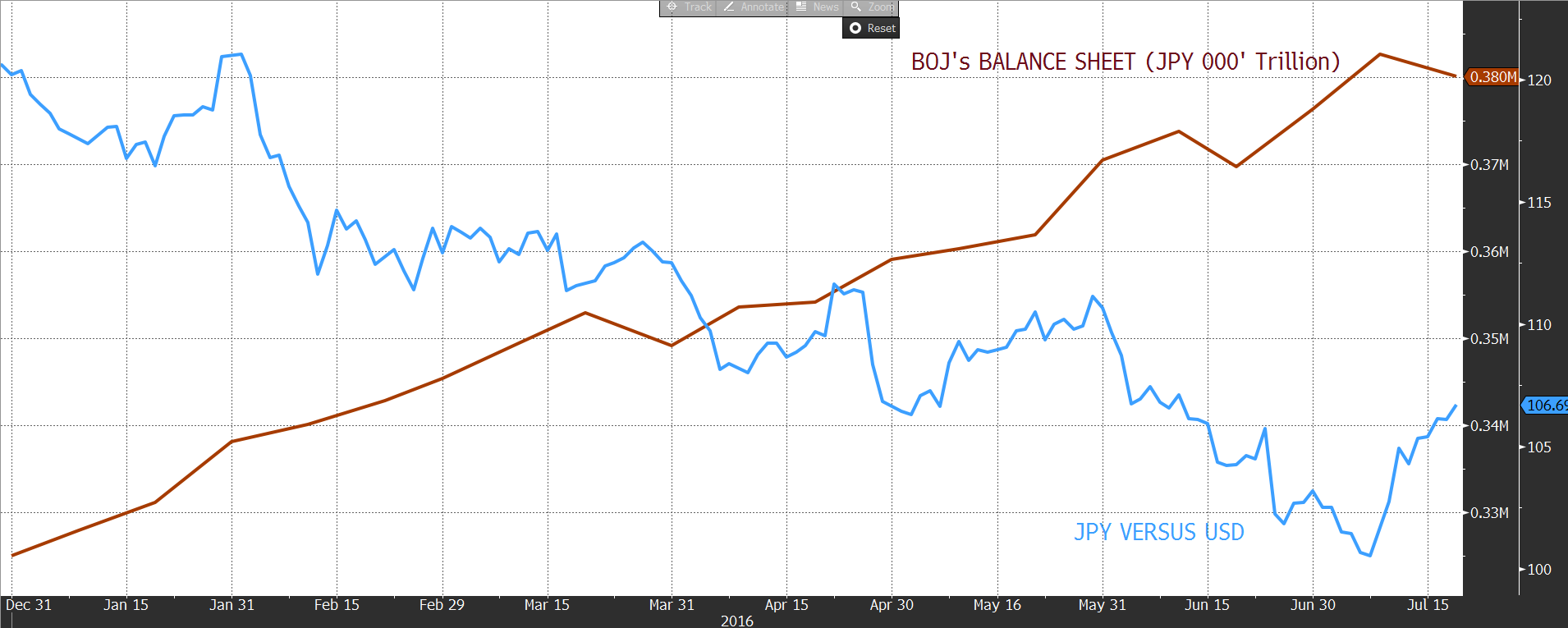

What is Japan’s desperate effort to lower its currency good for? Well when having a look at the chart below the answer is clear: nothing! Japan’s central bank has increased its balance sheet by 20% just for 2016 so far, and the result is pretty surprising because during the same period the Yen has risen by almost 15%. This result is exactly the opposite of what Japan’s monetary authorities were looking for, and as a consequence Japanese equities have tumbled in 2016.

Many strategists advised to go long Japanese equities and short the Yen in order to benefit from the supposedly good performance of the stock market without having to suffer from the Yen depreciation, whereas in fact the opposite strategy would have been a winning bet, i.e. go short Japan and long the Yen. The unwinding of this trade consisting in buying Japan and hedging its currency might explain part of this phenomenon, but in this case the question is why do investors sell Japanese equities?

In our view the best explanation comes from the fact that equity investors don’t believe in the global economic cycle and tend to buy non-cyclical stocks and markets essentially. The Japanese market has quite a high inherent cyclicality with large weightings in sectors like trading, finance and capital goods, which are all looked at with a high degree of suspicion this year, notably because of questions about China’s growth (and its implications on Emerging Markets), Europe after Brexit and the continuous problems of its banking system.

Nevertheless, with the US economy showing steady resilience and China apparently in a stabilization mode, investors should eventually consider the possibility of a better performance from cyclical sectors and markets: this would certainly help Japanese equities, which tend to show strong and rapid bouts of performance, with or without the help of the Yen.

The BoJ can try to counter the Yen appreciation by increasing again the size of its already ballooning balance sheet but as long as the global economic cycle does not improve, this policy will be, to quote Edwin Starr again, “nothing but a heartbreaker”.