Nowhere to run, nowhere to hide

Those of you that have aged well will remember the Billboard Hot 100 single “Nowhere to Run” by Martha Reeves & The Vandellas which was released in 1965 by Motown and copied & remixed by many such as The Isley Brothers, Laura Nyro, Michael Bolton and The Commitments (for you younger folks out there). At the time the 60% equities / 40% bonds (“balanced”) portfolio had already been around for over 10 years, invented by Nobel prize winner Harry Markowitz. The classic 60/40 portfolio has delivered an annualized return of 4.54% over the last 28 years with a Sharpe of 0.44. Fast forward to today and the conventional model which has been so successful historically has suddenly been turned on its head and questioned as the benchmark index was down 14.4% YTD as of mid-May! This is the worst synchronized decline for equity and fixed income benchmarks in history. So, have hedge funds finally earned their place at the dinner table? Not the case this year for most of the successful equity long short names in the industry, irrespective of their geographical focus.

Exactly two years ago, we wrote a piece titled “Survival of the Fittest” which was to be the blueprint for the enhancement of our multi-strategy low volatility mandate which had been running for over 20 years. A year later we wrote the sequel “In Pursuit of Looking Sharpe” after having implemented the changes outlined in our blueprint by adding a number of multi-PM platforms to the portfolio. In summary, the success of the multi-PM model is predicated on their ability of imposing strict stop-loss guardrails in order to prevent drawdowns in addition to being the most efficient allocators of capital to differentiated sources of alpha. Furthermore, multi-PM platforms are increasingly working with external managers enabling them to outperform their peers and produce higher Sharpe ratios (in addition to avoiding high acquisition costs associated with the traditional turf wars between the larger funds). Fast forward to today and as they say “the proof is in the pudding” following two years of live track record in the enhanced mandate. And thus, we truly have an all-weather approach as an alternative to fixed income that enables you to sleep well at night without having to worry about the extreme intra-day moves we have been witnessing of late.

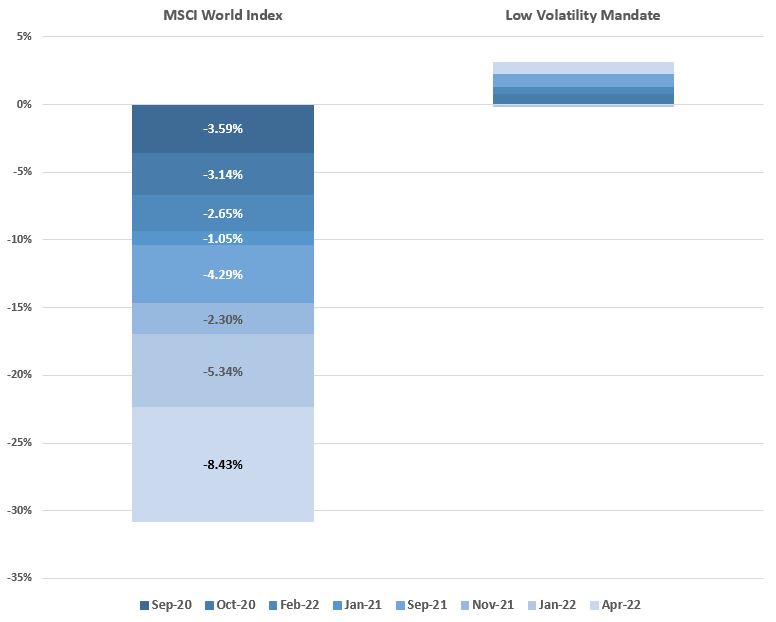

This month’s chart illustrates the sum of all the monthly drawdowns of the MSCI World Index over the last 2 years stacked up against the returns of our multi-strategy low volatility mandate during the same periods. So far, we are pleased with the live crash-test results with a spread of 33.75%, thus making it a viable “alternative” to traditional portfolios. This year Value, Growth and Momentum have been the biggest driver of single stock volatility (and unfortunately Quality has become correlated to Momentum recently) with many of the largest and most successful managers in the equity long / short space witnessing their largest drawdowns of their investment careers. In striking contrast, the equity long / short managers within the multi-PM platforms have been able to perform well due their factor awareness (if not factor neutrality in some cases) together with their low net market exposure.

Remember this famous quote: Crises take much longer to arrive than you believe and they happen much faster than you thought they could (the late Rudi Dornbusch – the economist who graduated from the University of Geneva)!

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group