Nifty – But not fifty

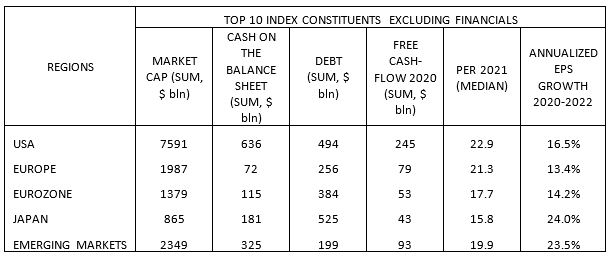

In this strange and hectic year for markets, giving ammunition to both bulls and bears, eyeballing the top ten constituents of major equity indices gives an indication of what can be expected, and at what cost, for the coming months: in the table below, we highlight different metrics for the US, Europe, the Eurozone, Japan and Emerging Markets.

First of all, what is striking in this table is the size and the quality characteristics of the US market: its largest companies’ market caps exceed the sum of all the others. The cash on their balance sheets and their free cash-flow generation almost match the sum of all the others, and their debt load is by far lower than the sum of all the others. This comes at a price, as their median PER exceeds the others as well.

Another remarkable fact is that Emerging Markets largest companies tend, for the majority of them, to also fall into the “Quality” side of equities, thanks to the IT heavyweights which did not show up some years ago (Alibaba, Tencent, TSMC, JD.com, just to cite a few). Thanks to this, the top constituents of EM share with their US counterparts some interesting features: cash exceeds debt, and just two years of free cash-flow suffice to pay down the entire debt burden. What a contrast with the Eurozone or Japan! And the reason for that is simple: there are still four “Value” or “Cyclical” companies in this top ten in the Eurozone (Total, Siemens, Bayer and Enel), and two in Japan (Toyota and Honda). The lower valuation of these markets seems justified.

And finally, if it is met, the median annualized EPS growth for the next two years looks appealing for all regions. Although it compares favorably for Japan, especially in relation to valuation, this must be relativized by the fact that there are two car manufacturers distorting the numbers here.

With these metrics, large caps equities don’t seem overvalued in general, whatever the region. On top of that, there are probably less risks of missed earnings expectations with the current large weighting in non-cyclical sectors, notably in the US and in Emerging Markets, and an optimistic investor can even hope for a stronger than expected economic rebound that would favor markets like Japan or the Eurozone. The US mega caps seem to be the less prone to bad surprises considering their solid balance sheets and high cash generation, which probably explains their higher valuation. But still, today’s valuations of highly popular stocks in the US are by no means comparable to the nifty fifty bubble, in particular when taking their growth prospects into consideration.

A blended and global approach in terms of stock-picking appears to be the best strategy when it comes to large cap investing going forward, with reasonable probabilities of generating pleasant risk-adjusted returns, especially when compared with other asset classes. Despite all the headwinds, the common wisdom that good things happen to good and well managed companies still prevails.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group