Is the lifecycle of the hedge fund industry over?

Numerous academic studies have shown that small funds outperform in their first few years of existence before they become victims of their success and subsequently attract too much money to perform in the investment strategy initially intended.

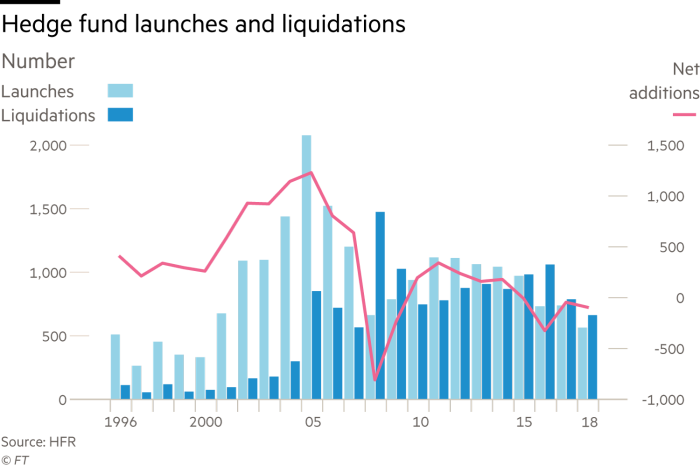

Recent history shows that an increasing number of launches are failing to gain traction and end up liquidating or long-standing managers converting into a family office after returning outside investor capital following disappointing returns (before they start outperforming again with their own money). One of the principal reasons is that the larger sized funds have become increasingly larger and competitive as they have been more successful in hiring new talent as they earn more fees. This new talent has come in the form of small and nimble investment managers that are able to actively trade limited amounts of capital within a particular sector (hence the multi-pm model with narrow stop losses e.g. Millennium, Citadel and Point72) to PhDs with a non-investment background that have been able to develop quantitative algorithms (e.g. D.E. Shaw, Renaissance and Two Sigma). The end result is that they have been able to challenge the classic old school hedge fund manager with a buy and hold approach in a concentrated portfolio of non-consensus trades with the ability to stomach volatility in exchange for outsized returns. As the traditional investor base in hedge funds has shifted from HNWI to institutional investors (endowments, SWF, pension funds etc.) that have a low tolerance to drawdowns and are happy with single digit returns, the average returns in the industry have deteriorated significantly. A declining industry is by definition less crowded which is a good thing for existing managers and the barriers to entry are much higher today than they have ever been.

At Notz Stucki, we pride ourselves in finding talented managers that are off the radar of large investors and can deliver the punchy but volatile returns and combine these with the larger multi-PM/quant managers with whom we have had long standing relationships, to attenuate the volatility of our overall portfolios. Yes the hedge fund industry remains challenged but still offers compelling opportunities particularly when markets are volatile. The short book for the average equity long / short hedge fund has clearly been a drag on performance in the last 10 years, yet there are a few outstanding managers that continue to be successful in this space. One often forgets the fact that in the past when interest rates were much higher, the cash from the short book was a source of returns whilst now it can cost you in a negative interest rate environment making it even more challenging for the industry.

The future of the hedge fund industry is still bright but one needs to be more selective in choosing the right talented managers that will continue to outperform over time.