How to become friends with Mr Market

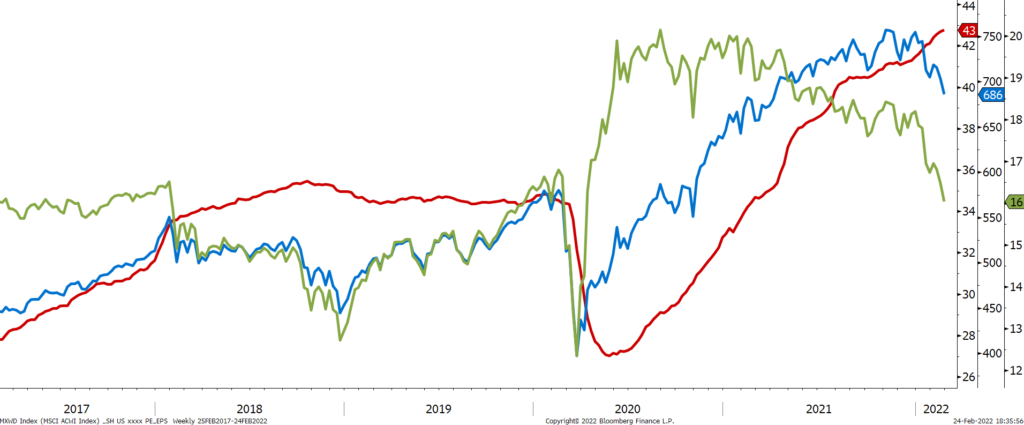

MSCI WORLD PRICE – MSCI WORLD EPS – MSCI WORLD PRICE EARNINGS RATIO

In his famous 1949 Book “The Intelligent Investor”, Ben Graham speaks about Mr Market.

Mr Market is a strange fellow with some specific attitudes:

Mr Market is very emotional. He can be euphoric or totally depressed.

Mr Market is often irrational

But Curiously Mr Market is frequently efficient, but not always. You never know with him…

Also, Mr Market is quite sarcastic at times and he loves wrongfooting investors.

Who is this guy, Mr Market? He offers you transactions, at your option. You’re never obliged to accept, because he comes every day with new deal offers, and at new prices.

With this in mind, thanks to him you can buy low and sell high. And he makes you feel like the King of the hill. But you can unfortunately buy high and sell low. And you feel like a victim.

But it is never Mr Market’s fault: it’s you who pushes the button to buy or sell, and he serves you, because once again he’s there every day. He never forces you.

So, you get the point: Mr Market is extremely emotional in his behaviour.

But he is totally agnostic to the people working around him.

Mr Market is certainly one of the most scrutinized characters in the world and in history: scientists, strategists, economists, politicians, portfolio managers work hard to try to anticipate his mindset. To try to read his mind?

And what about the immense computer work being done on that purpose!

But Mr Market has absolutely no sentiment.

He neither hates, nor loves any single investor.

Conversely, investors switch from one sentiment to another quite frequently: when they make money, Mr Market is so nice, so smart…. In this case investors feel like they have a superior IQ. They tend to claim loudly that they understand Mr Market, he’s a good friend, they know him very well.

But sometimes the same people will not find enough insults towards Mr Market: when they lose money, he’s stupid, irrational, crazy…… they will never ever again do business with him…

The main problem with Mr Market, the source of his versatility, is that he often becomes obsessive.

The topic of his obsessions changes all the time: it can be interest rates, oil prices, monetary policy, inflation, politics or geopolitics……. This makes a lot of things to worry about.

Easy to guess that so far in 2022, Mr Market has been extremely obsessed by geopolitics with the Russia-Ukraine war, but also by inflation.

But thankfully or not, his obsessions tend to be short-lived. Except the most important: Mr Market has one and only one long term obsession: corporate earnings. If he’s confident they will rise, then he will rise accordingly. If he believes earnings might disappoint, he will discount this setback and turn pessimistic and depressive.

Like for Mr Market, earnings should be investors’ first preoccupation. Investors tend to be blinded by short term factors, forgetting the big picture.

The second preoccupation for investors should be valuations. How much do you pay for a future flow of earnings and dividends?

As shown on the Chart of the Month, Mr Market offers you today transactions at prices that are not unattractive.

Prices have come down while future earnings should rise, hence valuation have shrunk to the levels observed in 2015, 2016 and 2017.

The estimated Price Earnings Ratio for the MSCI World stands at 16 today; this is not as low as it was at the end of 2018 or in March 2020 (it was 13.5), but it is much lower than during the last 18 months (it was closer to 21 times).

This is all investors should worry about long term: are earnings expected to rise, and are valuations reasonable?

This being said, we might be witnessing a change in leadership in markets, from large caps growth, essentially Information Technology and Communication Services, to a more broad-based leadership which would include Financials, Industrials and Energy for example, and this would be healthy.

In this context, we maintain our view that a well-balanced approach with a strong focus on quality will be the right strategy going forward.

Looking back in a few years, hopefully we will claim that Mr Market is a good friend of ours, although we know, Mr Market has no friends.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only. References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. NS Partners provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document. This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the NS Partners Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer. Additional information is available on request.

© NS Partners Group